The culture of beauty is deeply rooted in India where women were raised on ancient Ayurvedic principles. They believed in the value of everyday kitchen ingredients – coconut oil for sleek and strong hair, turmeric face masks for glowing skin.

These homemade remedies are centuries old, but today beauty in India is in the midst of an evolution.

As Bindu Amrutham, the founder of skin care brand Suganda told us, the market has radically transformed since it was formed in 2017.

“Natural, all natural! Back then they wanted everything to be natural like Ayurveda. The perception was that chemicals were bad for your skin. We were one of the first brands in India that shouted from the rooftops that you must choose ingredients based on safety and performance and not discriminate based on naturals and chemicals.”

When it comes to Ayurvedic beauty brands, consumers are still spoilt for choice with outfits such as Vedix, Forest Essentials, and SoulTree making waves.

And while there is still a huge appetite for such products, beauty consumers are more than ready to expand their horizons and explore products that may sit outside of their long-held beliefs.

This is especially true for the skin care category, where consumption has escalated in the past few years.

“India's going through a huge direct-to-consumer brand boom, and with so much money being pumped into the DTC market, brands are coming up with more innovative ways to market directly to the consumer in a way that the consumer understands. And when that started happening, the education and the awareness propelled in the market,” explained Shamika Haldipurkar, the founder and CEO of D'you.

D’you was conceived to solve consumer confusion around skin care ingredients and present solutions that are rooted in science. The company, founded in 2020, arrived on the scene at the right time as the education and knowledge around skin care accelerated partly because of the global COVID-19 pandemic.

“There’s been an educational revolution happening in skin care thanks to a group of skin care educators on social media. This has been happening in the last three to four years globally and has created a ripple effect in India. The lockdown during this pandemic is when we saw an exponential boost in awareness,” said Haldipurkar.

Product development: Hot categories and innovations

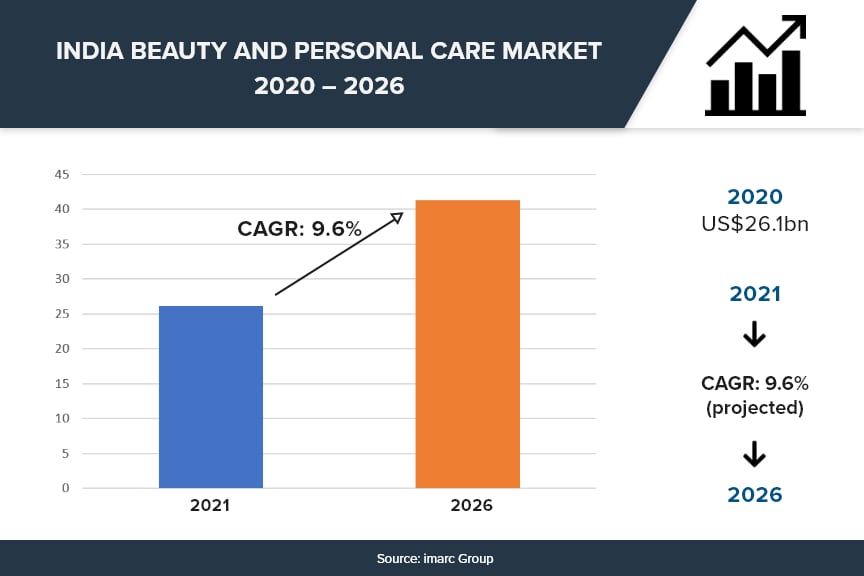

With thousands of people joining the ranks of India’s middle class every day, beauty brands have miles of room to grow in the market.

According to Purplle, one of India’s most prominent beauty e-tailers, two of the hottest categories on its platform are toners and serums.

“We identified that serums were becoming a trend back in 2018. In India, it was still very small then. If you looked at the Google search volume, it was just taking off. Toners were also a very small business in India five years ago,” said Manish Taneja, CEO of Purplle.

He added: “Today within skin care, serums and toners are upcoming and fast-growing categories in India… I would say that they are disproportionately larger than what anybody had thought it would be.”

According to Taneja, Purplle is one of the largest companies dealing in toners and serums today thanks its ability to identify future bestsellers based on the data it collects.

The company has invested heavily into the Beauty Intelligence Suite, a tool that can help itself and its brand partners identify emerging trends by crawling through the web for information.

Like women all over the world, Indian women have been subjected to obscenely unrealistic beauty standards. They have been pressured to alter their physical appearances to fit into society’s notion of beauty.

This birthed an industry dedicated to creating products that preyed on their insecurities while simultaneously selling them the ‘solution’. Fortunately, this mindset is changing.

One such example is Lisén, a cosmeceutical skin care brand founded in 2021 by Ramandeep Singh, whose family runs the 48-year-old cosmetics company Blue Heaven Cosmetics.

Singh told CosmeticsDesign-Asia that the brand was built on the foundation of empathy and was striving to get women to rethink their beauty values.

“There is a gap in terms of ideology. I think ‘anti’ is a strong word. Like anti-acne, it has so much negativity attached to it. But acne is normal, it happens to everyone – even to people who don’t typically get acne.”

Anita Golani, founder of iORA and Anita's Aromatics, concurs, adding that she believes consumers are now looking for “products that focus on making the skin healthy, and not just offering a picture-perfect look.”

Her brand iORA, for instance, focuses on microbiome skin care with its prebiotic beauty range that is vegan and cruelty-free.

Golani added that beauty is no longer as self-absorbed, and consumers are looking for products that espouse benefits that go beyond the individual. This means they are looking for products that are vegan, cruelty-free, organic and zero waste.

At the same time, there is a sense of excitement in the beauty world.

In 2020, Indian beauty unicorn The Good Glamm Group unveiled a 3,000sqft experiential store for its flagship brand MyGlamm.

The store, which claims to be six times larger than any beauty retail space in India, was described to CosmeticsDesign-Asia as a ‘beauty playground’ with make-up minibars, photo and video booths, as well as a stage equipped with public broadcast capabilities.

There is also excitement for new concepts and ingredients among consumers.

According to Taneja, the Korean wave has well and truly arrived in India and there has been a lot of excitement around ingredients associated with K-beauty.

“From an ingredients point-of-view, Korean ingredients are now dominating. We recently launched a serum with snail mucin and that became a top seller for us. We were very surprised by the success we saw in India. Another important ingredient is fermented rice water which is scaling up in India.”

Taneja believes K-beauty is set to be the next big trend in India. “There is a lot of respect for K-beauty in India. I think K-beauty has a lot of credibility with consumers and K-beauty will have a good run in India.”

However, he does think that K-beauty will have a harder time reaching consumers because of its price.

“I do think K-beauty is a little expensive for India as our per capita consumer is $12 a year. A lot of Indians cannot afford to buy products made in Korea because of the import duties and all the other charges we have to pay. But I’m assuming as things scale up, probably these Korean companies will start manufacturing in India and that would help them to reduce the cost quite significantly for the consumers.”

Another ingredient trend that has been building up in India is the demand for active ingredients.

“The Indian consumer is really hot for active ingredients right now, it started in the last one and a half years ago and consequently you will find a dime a dozen brands that are doing that now. “In the Indian market, there are brands catering to that active demand at every price point. Even in the tier three cities, there are brands serving that bracket,” said Haldipurkar.

Haldipurkar predicted that consumers are going to demand more innovations in this space, which is why she developed the Hustle serum which contained a total of 11 active ingredients.

“I knew if I wanted to make a difference and reach the consumer beyond the clutter, we needed to try and bring in some innovation. No point launching a product that is already there in the market just because they want actives.”

[Just A Minute... Quick Questions with the CEO of D'you Skincare]

Digital marketing: Breaking through the clutter

Mirroring global trends, it is no surprise that social media is one of the best channels to reach Indian beauty consumers today.

“That’s where consumers spend the majority of their time and discover beauty trends, products and brands,” said Priyanka Gill, co-founder of The Good Glamm Group.

However, with big brands, indie brands, content creators, and consumers all chiming in, breaking through the noise can be an extremely daunting task.

In August 2020, MyGlamm and women’s lifestyle platform POPxo came together with a shared content-to-commerce vision.

Pre-acquisition, the beauty brand was acquiring around 30,000 new customers a month.

“One month into the acquisition, the number doubled to 60,000 new customers. Today, the Good Glamm Group acquires 350,000 new customers per month which is a result of our content-to-commerce strategy,” said Gill.

For DTC brands, the biggest challenge is the ever-increasing cost of customer acquisition. The group has managed to control the cost by acquiring some of India’s leading digital media brands including POPxo, ScoopWhoop, MissMalini and BabyChakra.

“We recently invested 200cr ($26.8m) seed capital in Good Creator Co, India’s largest creator ecosystem with Good Glamm Group’s creator assets – Plixxo, MissMalini, Winkl and Vidooly. Today, Good Glamm Group leverages the power of content and creators to build up and scale brands and as a result, we also have the lowest customer acquisition cost in the country,” said Gill.

The band of digital media companies the group acquired has been consolidated to form The Good Creator Co, creating a “content-creator-commerce moat”.

“To have a successful presence and reach on social media, brands need highly contextual content strategy along with a robust content distribution strategy. To further establish your brand and to be effective on social media, influencer marketing is the way to go as influencers deeply resonate with beauty consumers and are very effective content creators,” explained Gill.

The importance of content is also not lost on Purplle, which has invested in nine production studios to produce content for each of its brands.

According to Taneja, the studios produce video content for its website as well as social media channels including Facebook, Instagram, and YouTube.

The studios are also capable of powering live commerce, which Manish expects will arrive very soon in India.

“It’s very early days, but we want to be ahead of the curve and invest [in live commerce] upfront. We’ll have to figure out the model, but we have the infrastructure ready, and our studios are able to shoot 12 hours a day and stream it live.”

But what about the smaller DTC brands that do not have the funds to splash on media outlets and production studios?

“The consumer has way too many products to choose from and it has become more critical for brands to concentrate on the differentiating factor to stand out within this clutter. That means a lot of their money just goes into digital marketing,” said Harini Sivakumar, founder and CEO of Earth Rhythm.

Sivakumar, like Gill, believes influencer marketing is one of the most effective forms of advertising for the brand. However, she has also found it challenging to keep up with the rising costs.

“The current trend is that consumers consume a lot of user-generated content. Hence, influencer marketing is a great tool to make your product stand out in the market. But if you look at it, it’s one of the most expensive marketing, more expensive than it was back in the day when we were just starting out in 2017 and 2018.”

While we cannot understate the importance of performance marketing, Haldipurkar cautioned that brands must not overdo it.

“I think there’s a fine line that crosses into overselling. In our first six to seven months, we didn’t do any influencer marketing. The product stood out and influencers spoke about it on their own. We got a lot of organic marketing and it worked nicely for us. In contrast to that, in our eighth month, we started doing influencer marketing and it didn’t do much for us.”

Money talks: Impact of fundings, mergers and acquisitions

With the Indian beauty market booming, it’s perhaps no surprise that start-ups had a bumper year in 2021, which saw the birth of 46 unicorns – firms with a value of more than $1bn – taking the country’s total to 90.

Among those that attained unicorn status were The Good Glamm Group and natural skin care brand Mamaearth.

Beauty and fashion e-commerce platform Nykaa debuted on the stock exchanges in 2021 year as well. According to Bloomberg, FSN E-Commerce Ventures, the entity behind Nykaa, saw share prices rise as much as 89% on its debut.

The success of its initial public offering (IPO) made founder and CEO Falguni Nayar India's richest self-made woman.

Its competitor, Purplle, raised a total of $140m in two funding rounds within a month of each other in 2021 and started off 2022 with another U$34m fundraise.

The Good Glamm Group also had a busy year raising funds and acquiring brands. In October, founder and CEO Darpan Sanghvi told CosmeticsDesign-Asia that the company had earmarked U$100m to acquire four to six more beauty brands.

By the end of last year, the company had acquired brands St. Botanica, The Moms Co. and Sirona.

With more investment activity in the beauty space than this article can accommodate, Sivakumar believes the market is headed towards consolidation.

“I think it’s a good thing these consolidations have started happening because it’s paving the way for the market to shape up. Right now, there are too many small brands fighting for the same customer with the giants like Unilever and Tata,” said Sivakumar, whose brand raised U$1.2m in seed funding in September 2021.

“[Consolidation] is a win-win situation because the giants won’t need to reinvent the wheel from scratch and the smaller brands will benefit from the distribution the bigger brands have already created. I think it’s going in the right direction.”

With investor sentiment remaining strong, high levels of innovation and shifting consumer mindsets, the outlook for India’s beauty sector looks highly promising.

And for those looking to crack the market, be they domestic or international brands, taking heed of some of the strategies for success highlighted above should prove a worthwhile start.