Embracing diversity and inclusivity has proven to be a catalyst for reducing societal hang-ups about ageing. It empowers us to challenge rigid beauty standards that prioritise youthfulness. In Asia, it reinforces a culture that traditionally appreciates the beauty and wisdom that come with age.

There has been a shift towards a more holistic approach to skin care rather than solely focusing on the erasure of wrinkles and the preservation of youth. The emphasis now lies in promoting healthy, radiant skin at any age, with an emphasis on self-care and self-acceptance.

The evolving anti-ageing skin category is aligned with the changing perceptions of ageing, empowering individuals to feel confident and beautiful regardless of age.

“Rather than perceiving ageing solely as a period of decline, it is now increasingly seen as an opportunity for personal growth, fulfilment, and new experiences… In Asia specifically, even though it's slow, it's gradually improving. There's less of a stigma surrounding it and people are more open to understanding why our skin functions the way it does,” said Pauline Ng, founder and managing director of beauty company Porcelain.

Brands like The Body Shop and Avon have begun to move away from terms like ‘anti-ageing’ and choose more positive terms like ‘pro-ageing’ and ‘well-ageing’.

Avon’s own research from 2021 found that 40% of women over 55 no longer considered fine lines and wrinkles to be their biggest insecurity. Instead, this group was increasingly focused on ‘authentic ageing’. The beauty company expects the term ‘anti-ageing’ to completely disappear from our vernacular.

Last year, The Body Shop risked a rebrand of its top-selling Drops of Youth range to stand against the negative connotations associated with ageing. In place of it, The Body Shop debuted Edelweiss.

“The rebranding of Edelweiss was to move away from the idealisation of youth. We wanted to move away from thinking or connecting it to anti-ageing. Instead, it's all about embracing your whole self,” said Felicia Sun, head of brand and activism, The Body Shop, Singapore.

Health over youth: A new marker of beauty

Heure is a Singapore-based brand that features SPHR, a proprietary encapsulated transdermal delivery system. This encapsulation technology works as a ‘drone’ targets specific areas of the skin to deliver actives where they are really needed.

Its Ageless range of products has been tested against leading global anti-ageing serums. The data sets showed there was 860% improvement in skin elasticity, 30% improvement in skin barrier function and 180% improvement in wrinkle reduction.

Despite its efficacy, managing director Han Lim said the brand does not promise customers that the Ageless range would “eradicate fine lines and wrinkles”.

“At Heure, we don't seek to stop time – we don't even seek to reverse time. Our ethos is to celebrate it, to celebrate it every moment of time. Our products give customers the greatest confidence to do so,” said Han.

A notable shift has occurred where health has become the new barometer. Ageing gracefully has expanded to encompass vitality and energy.

“If you could visually see that your kidneys and liver were unhealthy, you’d want to do something about it. The skin is our largest organ, and we have 24-hour visibility on it, so investing in skin health makes sense,” said Han.

The increasing emphasis on skin health underscores the understanding that healthy skin contributes to a more confident and vibrant self-image, as well as a reflection of our internal well-being.

With the Edelweiss skin care range, The Body Shop focused very strongly on skin resilience, instead of conventional anti-ageing beauty jargon.

“Today, it’s all about self-love and that’s always been a big topic for The Body Shop. We’re all about helping embrace who you are as a person as you move along the journey of life. It’s about ageing gracefully and helping your skin become stronger and more resilient helps you to do so,” said Sun.

“[Edelweiss] does just that. It helps to make your skin stronger and protect it against harsh elements like pollutants or any other external aggressors – that's how it makes skin more resilient.”

This is driving interest in ingredients like ceramides in well-ageing skin care. The use of ceramides has widely been associated with products for sensitive skin, however, there is growing interest in it as a healthy ageing skin care ingredient for its skin regenerative prowess.

“The best way to go in the direction of well-ageing is to protect your skin barrier right from the beginning. We acknowledge that we all age, that’s not going to change, so we now want to age beautifully,” said Silvana Estarita-Jäde, senior marketing manager of active ingredients at Evonik.

“Our skin barrier is made up of ceramides, 40% of our skin barrier contains ceramides. The idea of applying on the skin ingredients that you already have in your skin, and that you'd normally lose with age is like the perfect approach. Customers want this complexity that we have in our skin in a product to target to have the most performance as possible.”

On the flip side: Proactive beauty

Beauty is a deeply personal and subjective experience, unique to each individual. Society's emphasis on youthfulness can create anxiety and pressure to defy the signs of growing older. While there are some who embrace ageing, there are others who have more concerns and worries about the ageing process.

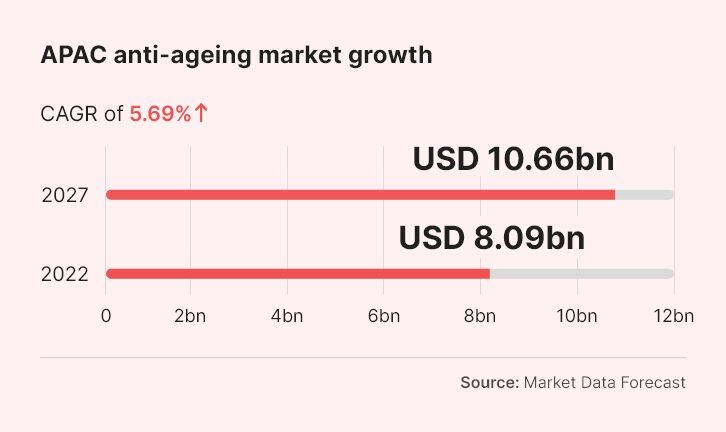

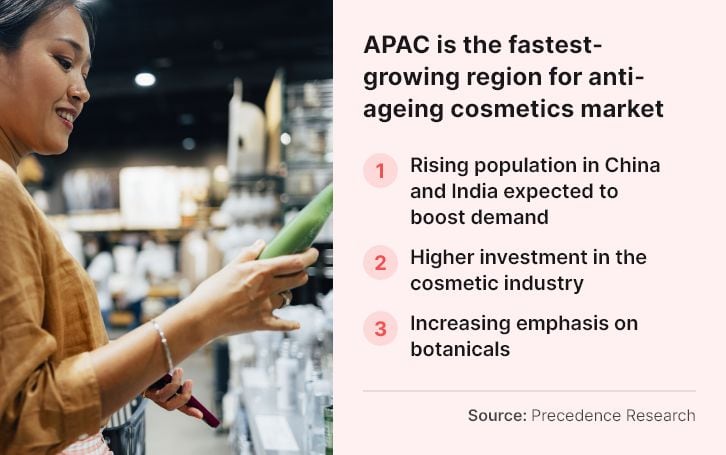

In Asia, demand for ageing skin care products is not just being fuelled by a large ageing population, but a large young population that is taking a more proactive approach to the ageing process.

“We see more clients skewing towards our preventive ageing line, Plus+, that focuses on slowing down the unavoidable effects of modern stressors, which is what is causing our skin to be more easily reactive to external changes caused by the environment and products, and ultimately causing our skin to age more rapidly.”

At the same time, this is driving this group of consumers to seek out medical aesthetic procedures to address specific niggling concerns.

“A trend that is quite important in Asia is called protective prevention. This is among younger consumers, in their 20s and 30s. It’s common for them to go for aesthetic surgery for little wrinkles. Similar to older consumers, they will look for anti-ageing products to help them stay young,” said Nicolas Lasbistes, DSM regional marketing head, personal care.

A quick survey of my own circle of acquaintances of millennials yielded a surprising number of people who have undergone aesthetic treatments. Those that have not said they were considering aesthetic treatments or would consider it in the future.

“I think they're as common as getting a facial nowadays, due to the increasing awareness and acceptance of people who choose to undergo these treatments. It's also more affordable than a decade ago, and the presence of social media, influencers, filters, all definitely contribute to the never-ending pursuit of looking more and more youthful as well, so it all goes hand in hand,” said Ng.

Those who have opted of medical aesthetic treatments cited the influence of social media as well as the accessibility and affordability of these treatments, especially in countries like Thailand and South Korea. They explained the convenience of being able to contact a clinic overseas for an online consultation before deciding to fly over for the treatment.

Another reason is that many modern treatments are non-invasive and require minimal downtime. When done – and done well – you can hardly discern any indications of enhancements.

A common and popular treatment is High-Intensity Focused Ultrasound (HIFU) treatment, which is widely considered a safe procedure and a non-surgical alternative to traditional facelifts, offering noticeable results with minimal downtime.

Elevating standards: High performance needed

Lily Kew, founder of salon and skin care brand Kew Organics has accepted that aesthetic treatments were becoming part of the beauty routine of the modern generation.

“It's so accessible and so easily available. They look around them and see their colleagues and friends doing it. Some feel they have to jump on the bandwagon. Now the trend is that people will go for fast treatments then use facials as a way to maintain the skin in between,” said Kew.

The rise of medical aesthetics will undoubtedly greatly influence the future development and innovation in this category.

Kew Organics developed Needle-less Rejuvenation in response to this trend. The collection was developed for people who encounter such side effects, as well as those who may not want to have such invasive treatments.

“The idea was to bottle up ingredients like peptides and amino acids so people can use it every day without the needles and without the side effects. The products are a mixture of botanicals, organic certified ingredients as well as ingredients you would find in things like fillers,” said Kew.

Kew has been extending the line-up dedicated to this group of consumers. Most recently, she launched the Resurrect Synbiotic Booster, combining probiotics and prebiotics to aid skin barrier function.

“As people do more procedures, the aftermath is usually thin, weak, and sensitive skin. It will definitely cause the immunity and strength of the skin to weaken. My goal was to strengthen the skin barrier.”

This is also prompting brands to develop more high-performing products to compete with these fast-acting treatments.

“Consumers are always impatient. But because the medical aesthetic industry has grown so much, it is definitely pushing us skin care brands to develop more high-performance products. You can see brands using bioactive ingredients in higher percentages so you can get faster results,” said Julius Lim, co-founder and CEO of B&B Labs.

And it seems like they are also willing to pay more for better results.

French pharmacy favourite Caudalie recently launched Premier Cru a line-up dedicated to helping people address eight signs of ageing. The company partnered with Dr. David Sinclair, an expert on ageing and epigenetics to develop the TET8 technology, which targets TET enzymes to activate the skin’s youth proteins like collagen, elastin or hyaluronic acid.

Premier Cru is not only Caudalie’s most powerful skin care range, but also its most luxurious. Its serum would set you back EUR98 (USD107) for 30ml, compared to its best-selling Vinoperfect serum, which goes for EUR50 (USD55) for the same amount.

Despite the price increase, the range launched in Europe, the US and SEA to “great success”, said Jean-Christophe Samyn, general manager, South East Asia, Australia and New Zealand. In just a month, the Premier Cru range accounted for 15% of its sales in Singapore and Thailand.

“We’re more than pleased, it’s been super successful. The price point is more than normal for us, but we felt that with the technology behind this, the performance and the clean formula show the value of the product,” said Samyn.

Bridging the gap: Underserved demographics

While many skincare brands actively target younger consumers, it often neglects to connect with more senior consumers.

“It’s quite a blue ocean, but it’s not that there are not enough products in the market, I think it’s the lack of communication. Today, the most prevalent form of marketing is on social media, so that older demographic ends up gets lost,” said Julius.

Julius cited the success of American brand BOOM! By Cindy Joseph, which challenges the conventional beauty industry's emphasis on anti-ageing and instead embraces the natural ageing process as a beautiful and empowering journey.

This sector is relatively untapped in APAC, but important especially in hyper-aged societies like Japan. The Statistics Bureau of Japan recorded that one in every four persons in Japan was aged 65 and above. In 2020, this population was 36.19 million and accounted for 28.8% of the total population.

A survey conducted by Pola Orbis on 546 consumers in their 60s reported that a majority of respondents (77.9%) expressed an interest in caring for their appearances “no matter how old they are”. This group had a “high sense of beauty” and a desire to express themselves regardless of age.

In response to this, the company launched Orbis Amber, skin care range dedicated to people in their 60s.

This untapped opportunity has not been lost on fellow J-beauty major Shiseido. While people above the age of 65 tended to consume fewer cosmetic products in the past, Shiseido expected this to change in Japan.

“As we are seeing more active seniors, we know that the senior demands will increase. So, we will enhance our proposals to the senior market, including further R&D efforts,” said its Japan CEO Norio Tadakawa.

The company has been releasing more innovations under Prior, a beauty brand established in 2015 dedicated to mature women aged 50 and above. The brand is available primarily available in its domestic market and offers a range of skin care, hair care, body care and make-up products.

Apart from the typical skin care products, the brand has launched makeup catered to older consumers, such as a cream eye shadow that claims to care for the eye area with ingredients such as Argan oil and hyaluronic acid.

The multifunctional eye product was developed to “feel like skin care” and claims to hydrate and brighten the eye area while also concealing wrinkles and dullness.

To succeed in this thriving beauty segment, brands must embrace the changing narrative around ageing and promote a positive, inclusive image of beauty that celebrates all ages. There are still gaps in the category waiting to be turned into opportunities.

As medical aesthetic treatments become more accessible, brands must prioritise innovation by continuously developing advanced formulations, cutting-edge technologies, and unique delivery systems to offer consumers the highest-performing products possible.