As a key growth driver within the Kao Group, the Cosmetics Business is targeting net sales of JPY400 billion (USD2.68bn) and an operating margin of 15% at the “earliest feasible time” after 2030.

To realise this ambition and align with the company’s mid-term management plan K27, a set of strategic initiatives have been announced.

This includes dividing six brands poised for global growth into three distinct overseas expansion models, sharpening brand positioning and enhancing competitiveness in the international market.

Kao will also be leveraging its myriad technological assets as a diversified chemical manufacturer, applying its fundamental technologies across various brands and categories.

By integrating human expertise with artificial intelligence (AI), the company will maximise sales capabilities, further streamline supply chain management, and reduce fixed costs to strengthen business foundation.

These initiatives will be led by Tomoko Uchiyama, executive officer and president of Global Consumer Care – Cosmetics Business, who assumed her role in January 2025.

After playing an important role in transforming Kao’s hair care business, Uchiyama will now be in charge of driving the growth and renewal of the Cosmetics Business.

“Our Cosmetics Business has the flexibility to respond to changing times and market dynamics with a diverse portfolio of brands. By combining this agility with the broad and solid foundation of the Kao Group, we will serve as a pioneer within the company in advancing globalisation and accumulating expertise.

“To that end, we will pursue a strategy centred on the six brands, aiming to establish a strong earnings base by 2027 through both growth initiatives and structural reforms. Building on this foundation, we will target sustainable growth, striving to achieve ‘Global Sharp Top’ with a brand portfolio that blends scientific evidence with sensorial beauty,” Uchiyama stated.

Eyes on six brands

Kao’s six focus brands are namely SENSAI, MOLTON BROWN, KANEBO, SOFINA, Curél, and KATE.

The company will accelerate overseas expansion in markets where these brands address consumer needs, and can capitalise on Kao’s resources and expertise.

Backed by more than 40 years of expertise in dry, sensitive skin and over 25 years of ceramide research, Curél will be doubling down on its expansion in the European market — including increasing store presence in the region by six times, with a goal of generating 50% of total brand sales outside Japan by 2027.

The brand first entered Europe in 2019 and has since gained strong traction. In the first half of 2025, sales in the UK rose 70% year-on-year, underscoring robust demand.

For SENSAI and MOLTON BROWN, which have resonated well with consumers in Europe’s luxury segment, the strategy will now focus on capturing growth in the rapidly expanding Asian luxury market.

Through “integrated operations” that manages Asia as one market for global shoppers, Kao aims to increase SENSAI sales in Asia (including Japan) by 150%, and MOLTON BROWN sales by 100% by 2027, compared with 2024 levels.

Under the “Asia Model”, brand values developed in Japan are adapted to meet the unique characteristics of Asian markets.

Thailand, with its strong cultural affinity to Japan in areas such as makeup and anime, will serve as the pilot market.

“Kao will concentrate on the KANEBO and KATE brands to establish a successful blueprint for regional rollout, targeting sales growth of 150% in Thailand by 2027, compared with 2024 levels.”

At the same time, the company is set to reposition SOFINA, unifying its sub-brands under the SOFINA umbrella.

Since its launch in 1982, SOFINA has built a strong presence in Japan with its science-driven approach to skin care and makeup. Kao aims to increase the brand’s sales in Asia (excluding Japan) by approximately 50% by 2027.

Less cost, more profit

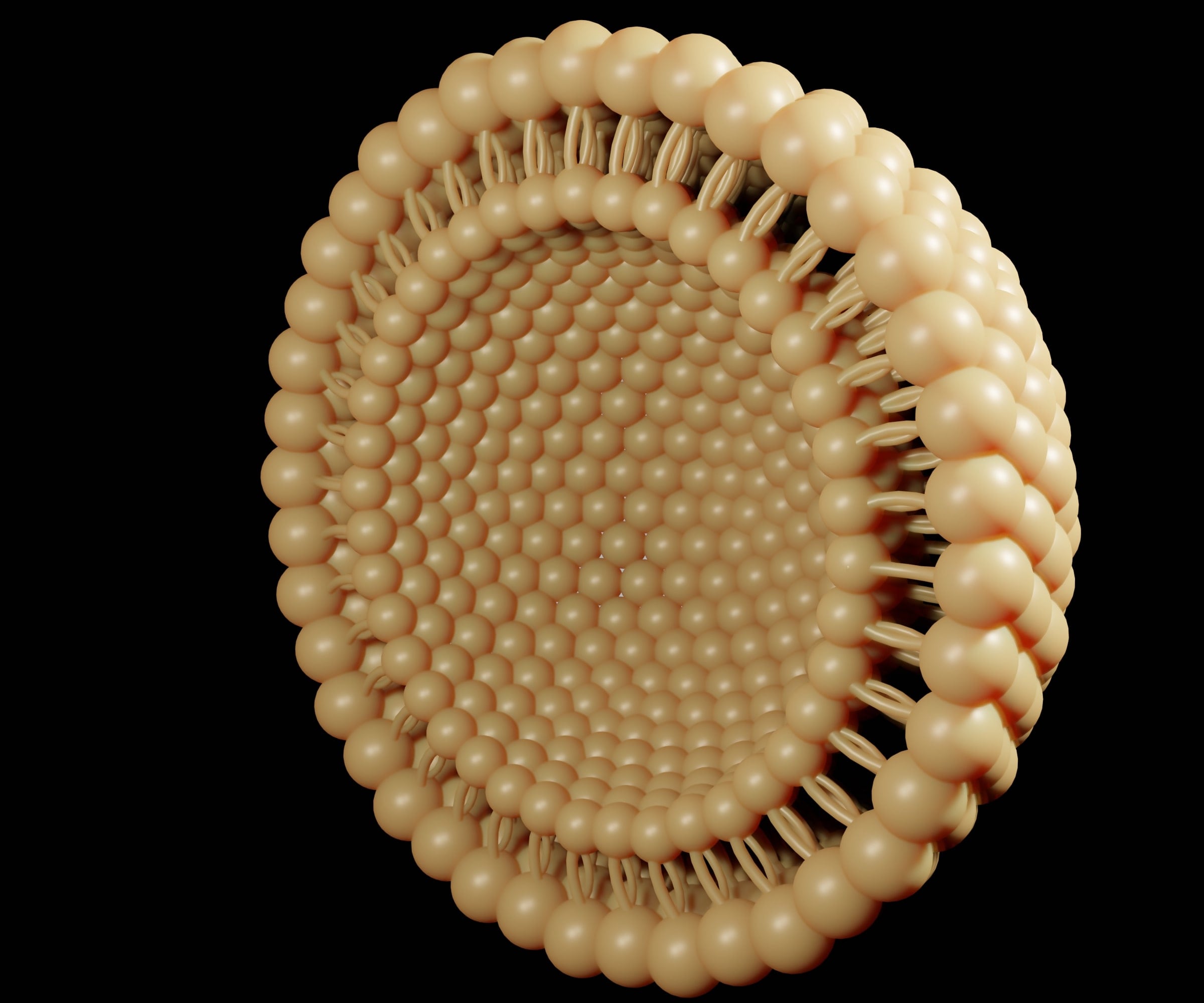

Kao’s technological assets span dermatology, bioscience, chemicals, and production processes.

By integrating these extensive assets, the company seeks to achieve effective investment by sharing of strong technology-driven differentiation.

In addition, by tapping into the expertise of its workforce and incorporating digital capabilities and AI, Kao intends to maximise sales potential and improve supply chain management efficiency.

This will lead to further fixed cost reductions and establish a more resilient business structure.