Based on the 2026 Olive Young Trend Keyword report, the spending of Gen Z (born between 1996 and 2010) is increasing twice as fast as previous generations of the same age, with this group forecasted to account for 25% of luxury spending by 2030.

Although seven out of 10 Gen Z save up in their daily lives, they reportedly have a tendency to spend boldly, particularly in premium categories, if they think it is worth it and where their priorities lie — for example, luxury clothing (34%) and beauty (29%).

In addition, Olive Young has observed that Gen Z consumers are gravitating towards “one-bite luxury” that caters to their individual taste.

This means that they prefer mini or small-capacity packaging to try a wider variety of products and to reduce the “cost of failure” in the event that a product is not to their liking.

Data cited in the report showed that the percentage of premium brands experienced for the first time in mini sizes was especially high among 15- to 29-year-olds (40%), compared to other age groups (27% for 30 to 39, and 24% for 40 to 49).

Small-dose products that are easy to carry around and can be tried without burden also tended to receive good initial responses from 15- to 29-year-olds.

Another major appeal for this demographic is “scarcity”, with 41% of them saying that it is an important factor in their purchasing decisions.

“For Gen Z, buying luxury is more than just a possession. They use limited-edition and exclusive products as a means of expressing themselves and differentiating from others. Not only the product itself, but where they bought it from is also recognised as part of one’s identity,” the report stated.

However, due to the evolving world view of this generation, they are making more conscious and rational choices, such as choosing products with a story that they empathise with and align with their values, rather than blindly chasing after rarity.

According to the report, 68% of Gen Z consumers said that they buy a product because of the story attached to it, not just because it is limited edition.

At the same time, sales channels for luxury purchases are expanding beyond a brand’s own platforms, as young consumers are increasingly relying on platforms that have proven to be the “best choice” among myriad options.

“The exclusivity of ‘you can only buy here’ acts as a powerful luxury purchase trigger factor.”

The pursuit of “wholeness”

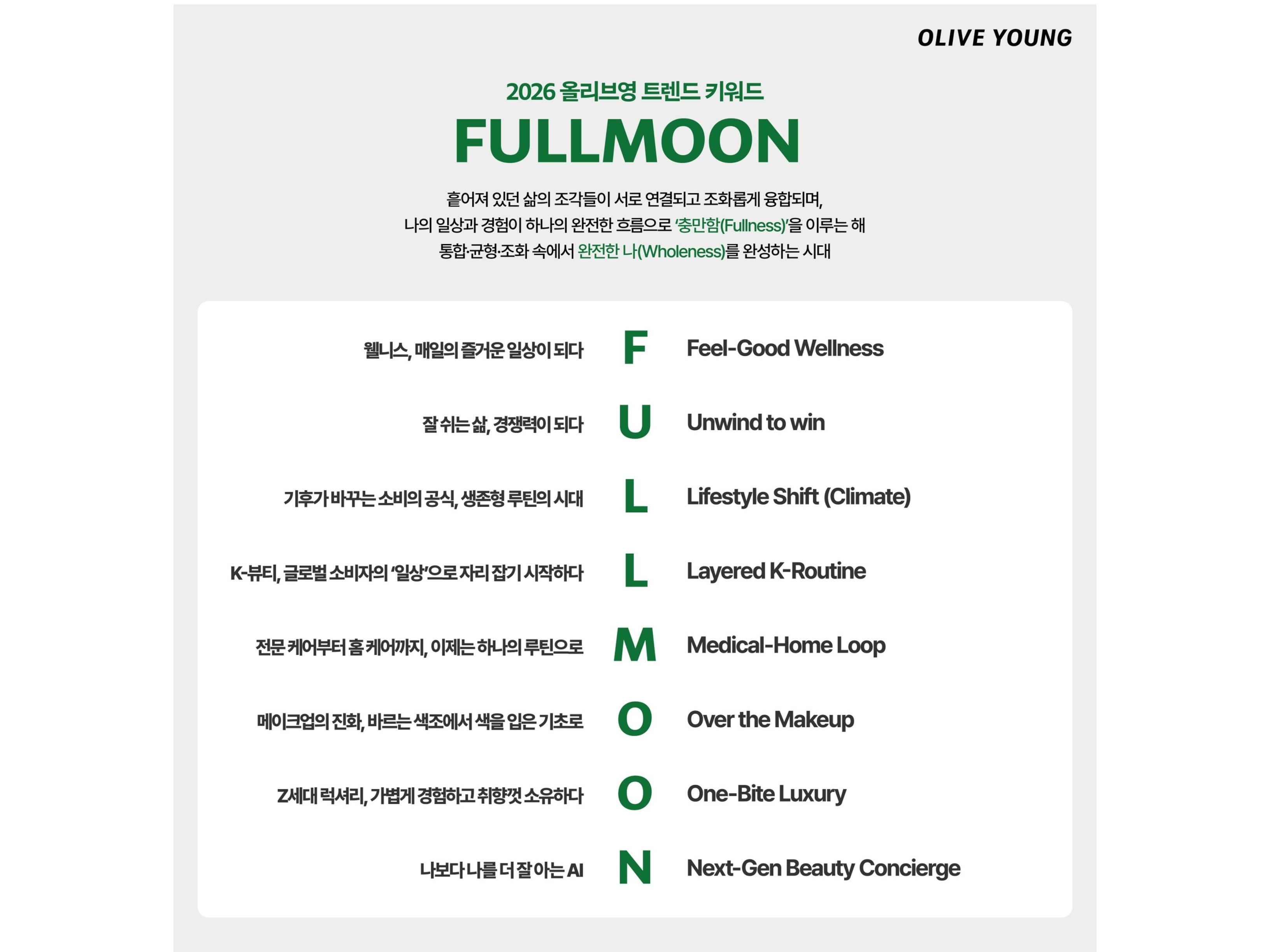

Alongside the report, Olive Young has selected “FULLMOON” as a keyword for the 2025-26 K-beauty and wellness industry.

According to the company, the movement to pursue wholeness stood out among overall trends in 2025. Globally, there has been a striking rise in the wellness trend.

“Consumers in the US, the UK, and China overwhelmingly ranked wellness as a top daily priority. This clearly demonstrates that wellness, along with K-beauty, has emerged as a new consumer trend in the global market.”

This is supported by Olive Young’s sales data — the number of people aged 15 to 24 purchasing wellness products at Olive Young have been experiencing double-digit growth every year since 2022.

As this group increasingly seeks to care for both their appearance and inner self, a trend touted as “early wellness” is burgeoning, resulting in renewed attention on recovery care, skin care, and makeup.

“The trend of embracing wellness as a daily routine is growing. Consumers are beginning to adopt wellness without setting aside extra time, with skin, body and hair care products containing melatonin, magnesium, and vitamins emerging.”

Olive Young predicts that wellness will expand beyond nutrition-focused approaches to include lifestyle-focused care tailored to individual lifestyles.

The strive for wholesomeness is also evident in the makeup space. For instance, functional makeup, which goes beyond mere cosmetic application to address skin conditions, is gaining popularity, leading to a burgeoning perception of makeup as an extension of skin care.

Consequently, the hybrid product category is rapidly expanding, with the launch of not only colour cosmetic products containing highly functional ingredients, but also skin care products with added colour.

Olive Young said that consumers are now considering the ingredients in makeup products outside of their primary functions, such as colour payoff, coverage, and staying power.

In fact, searches for skin care keywords like soothing, barrier, and hydration in the makeup category in 2025 surged by over 150% year-over-year.

“Beauty brands are also developing colour cosmetic products utilising natural ingredients and patented technologies, demonstrating an evolution toward derma colour cosmetics.”

Other beauty trends discussed in the report include K-beauty in the daily lives of global consumers, “professional self-care” where aesthetic treatments and home care are interlinked, and next-generation AI personalisation.

“This report highlights the emergence of numerous new trends in the K-beauty and wellness sectors, while also highlighting the growing trend towards hyper-personalised value consumption. We will continue to uncover and present these insights across domestic and international markets, fulfilling our role as a leading platform.”