The data specialist’s 2019 Q3 Global Survey – conducted across 40 countries with more than 29,000 respondents – investigated a wide range of topics, including shopping behaviour, packaging preferences and general health concerns. More specifically, it looked at consumer views on the health impact of 50 food and drink ingredients and the appeal of 25 beauty and grooming ingredients and ten household care ingredients.

Findings showed that ingredients considered to be more ‘natural’ by consumers held most appeal. Aloe vera, grains and pulses and honey were the top three most appealing ingredients identified in food and drink, believed to be good for the body.

The survey showed that consumer desire for more natural ingredients also held true in beauty and grooming. The most appealing ingredients within the category were vitamin C, vitamin E and fruit or vegetable extracts – “not surprising, given these ingredients portray a ‘health halo’ due to their ‘natural’ reputation”, said GlobalData.

‘Real’ and ‘highly natural’ ingredients

Amira Freyer-Elgendy, consumer analyst at GlobalData, said the desire to consume products with natural ingredients could be seen across the board – in food and drink, household cleaning and beauty. The definition of what constituted a natural ingredient, however, remained unclear.

“’Natural’ as a concept is somewhat contested. Consumers have a very varied definition of it, sometimes referring to sustainable production methods, the freshness of the ingredients or the product’s free-from credentials, like allergen-free and non-GMO,” Freyer-Elgendy said.

Despite this, she said the “most common definition of natural” was ‘real ingredients – a definition particularly sought out in food and beverages.

This desire for real ingredients, she said, could also be seen within household care, with lemon, oxygen and plant extracts the most appealing ingredients in this category and perceived as “highly natural”. These three ingredients, she said, were also likely preferred due to the health and environmental concerns of other ‘harsher’ ingredients. Chlorine, for example, was identified as the least appealing ingredient in household care “due to being seen as less natural and more chemical-based”, she said.

Charcoal, food waste, insect extracts

Survey findings also identified certain ingredients consumers were less enthused about.

In beauty and grooming products, charcoal, food waste and insect extracts were ingredients that consumers worldwide continued to “remain wary of”, GlobalData said.

Charcoal, for example, was considered unappealing by many because it was “not widely understood or known”, the survey showed.

“Brands will need to communicate the efficacy and appeal of these ingredients more clearly to consumers to make these more appealing,” Freyer-Elgendy said.

Cannabis confusion

The Q3 Global Survey also identified cannabis or marijuana as the ingredient considered to be the unhealthiest, with 48% of consumers associating it with a negative effect on the body.GlobalData said this health perception of cannabis was clearly influenced by age, with 23% of millennials holding “more positive” views and believing the ingredient had a positive effect on the body, compared to just 15% of baby boomers and 8% of silent generation consumers.

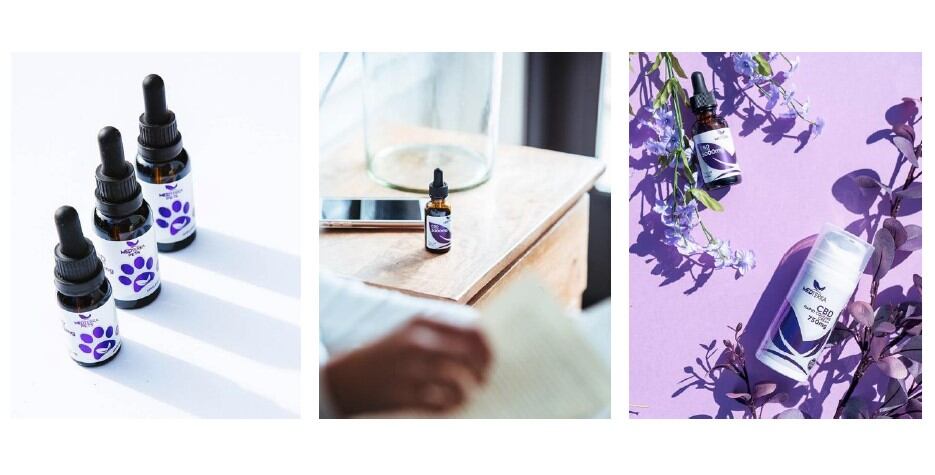

“The shift in opinion is part of a changing cultural view on the drug, in part illustrated by the popularity of CBD products,” GlobalData said. However, there remained consumer confusion around CBD (cannabidiol) and products containing this ingredient.

Survey findings showed 39% of consumers did not know whether CBD was appealing or not – highlighting the level of confusion around CBD products, GlobalData said.