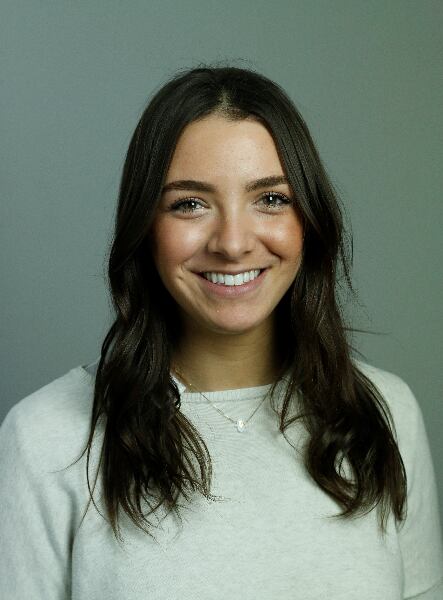

Cosmetics Design spoke to Euromonitor International research analyst Gabriella Beckwith, to find out how this continued evolution is impacting the category and what the key opportunities are for brands targeting this area.

The trend has definitely dominated in the more developed markets, particularly in the US and the UK, but as exercise and on the go continues to become more popular in other regions, so the trend is also finding new consumers all over the globe.

Active beauty highlights make-up safety

Beckwith explains that the trend for Active Beauty first emerged on the back of the need for sweat-proof make-up, ensuring it would stay on and still look good during workouts or other instances where the user might experience sweating.

However, Beckwith also explains that as the trend bought about awareness of the potential dangers from some color cosmetics formulation during sweating, the category has also evolved to include natural brands that have also been formulated to stay in place while avoiding such dangers.

“As an example of this, Sweat Cosmetics, started by five professional athletes, offers make-up specifically for active consumers, that is UV protected, oil, fragrance and silicone free,” said Beckwith.

“More recently, active beauty has broadened to include ‘lifestyle brands’, centred around general fitness and wellbeing, as well as specific sporting activities, such as Yoga inspired brand YUNI. The lifestyle concept also includes smaller formats; we are seeing brands such as Stowaway Cosmetics offer travel-sized beauty products for the purpose of consumers keeping them in their gym bags.”

What is driving the demand?

Cosmetics Design asked Beckwith what is causing the demand for the Active Beauty and its continued high growth levels, which she believes is coming from three different areas – the growing trend for fitness and exercise, the influence of fitness bloggers and the demand for on-the-go more convenient products.

“The number of consumers globally participating in physical exercise 1-2 times a week, has increased by almost 6% since 2013. Secondly, for many consumers the gym is no longer just a gym, it has become a hang-out location, a way to socialise, meet people, and add to their Instagram feed,” said Beckwith.

“The influence of fitness bloggers posting pictures of their workouts on social media has encouraged others to follow suit, and for many this forms a key part of their online personal brand. Consumers ultimately have a greater need to look good and feel confident at the gym.”

The analyst also notes that because many consumers also have busy schedules, trying to fit in workouts with other appointments and commitments means that don’t have always have the time to cleanse and reapply make-up, which makes active beauty color cosmetics an important time saver to get them through the day without having to reapply products.

The typical consumer and the biggest brands

So what is the typical profile of an active beauty consumer? Beckwith points out that this is generally focused on the younger demographic, who regularly exercise, are influenced by social media and also have a keen interest in beauty.

As for the brands that are leading the way in the active beauty trend, they include Yuni Cosmetics, which was started by yoga teachers and also includes a hair oil activated by body heat, together with other names such as Sweat and Stowaway, while brands such as Pretty Althletic and Sweatwellth have carved names out for themselves by offering pre- and post-workout body care products.

“Interestingly, we are also seeing brands such as Ahava and Elemis, who are not necessarily launching athleisure lines, but repositioning existing products that contain muscle relief qualities, as ‘post workout’ products, in order to relate to the trend,” Beckwith said.

Targeting men and older consumers

But increasingly the category is also broadening out to target men, with brands such as Proverb and AB Crew also targeting active male users who want to look their best when they leave the gym.

Meanwhile older consumers are also picking up on the trend, with Euromonitor’s statistic showing that the number of people aged 45 – 59 years old who participate in physical exercise once or twice a week has risen by 10% since 2013.

“In particular, these consumers are interested in the use of products that combine body care with muscle relief properties,” Beckwith said.

Where is this trend going in the future?

Looking ahead, Euromontior analysts believe the continued rise of active beauty should lead to continued industry leading growth on a global basis and should lead to new opportunities on the horizon, particularly for ingestible products.

“The emergence of new brands and advanced innovations will continue to drive the active beauty trend. Global sales of sportswear are predicted to hold continued high growth of 4% CAGR between 2018-2022, indicating that consumers will continue adapt to more active lifestyles,” said Beckwith.

“We will likely see the rise of more ingestibles and supplements, a trend we are seeing emerge across the whole beauty industry. Brands such as The Nue Co. have released supplements with energy boosting and fat burning properties.”

Apparel manufacturers set to make the leap

As with most new categories, active beauty is also likely to show some clear signs of maturation, with distribution for these type of brands likely to expand into new areas, specifically apparel.

“As apparel retailers increasingly move into the beauty space, there remains a strong opportunity for sportswear retailers to do the same within active beauty,” Beckwith said.

“For example, UK retailer Sports Direct has begun selling make-up by SportFX. Lastly, the industry predicts further synergies between activewear and active beauty, including innovations such as clothing that advises what products to use in order to maintain optimum skin temperature and hydration levels during exercise.“