EXCLUSIVE IN-DEPTH INSIGHTS

How to win over… protective mothers in a rapidly growing baby personal care market

The toddler’s personal care routine used to be ubiquitous for parents everywhere. For most of us, for years it consisted of the Johnson & Johnson trio – No More Tears shampoo, baby oil, and baby powder. So much so that we all unanimously agreed that J&J baby powder was the de facto ‘baby smell’.

By the time the 2020s rolled around, we were well obsessed with natural, organic, and clean beauty and personal care products. And because parents will always want the best for their little ones, we transferred our own consumption values into shopping for our children.

Unsurprisingly, the main target market for baby care brands are mostly women who are young mothers. This is the case for Aussie baby care brand Lovekins.

“I would say 24 to 45 is our sweet spot in terms of age demographics. Purchasing is predominantly women – roughly 85% are female and the other 15% are male, mostly fathers buying the skin care and nappies for their kids,” said founder and CEO Amanda Essery.

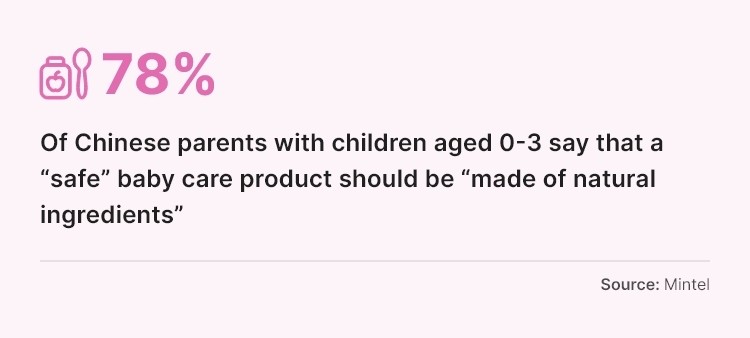

Health and wellness are highest on the consumer agenda, and this market is no exception. When it comes to baby care, safety is the biggest concern for parents.

This is a particularly sensitive topic in Asia Pacific, where parents today are still haunted by the Chinese milk scandal of 2008. This tragedy saw over 300,000 children in China poisoned and six dead from consuming melamine-laced infant milk formula.

And with scandals plaguing even the most established names in baby care today, parents want to be reassured of safe and transparent personal care formulas that can care for the delicate skin of their babies.

“Now we find that retailers are looking for more alternative natural, vegan, organic-type products. They have insight into the consumer, which means the consumer is also looking for that – which is good news for brands like ours,” said Peter Bosevski, global marketing and sales manager of G&M Cosmetics, which owns the vegan baby care brand P’URE PapayaCare Baby.

The brand is available in various markets, from Australia to China. Most recently, it has expanded its presence further in South East Asia by launching in Thailand.

“I think what we're seeing now is that all different markets, from Vietnam to Indonesia, to Taiwan to Australia, the consumer is almost becoming the same. That’s not a bad thing or a good thing. It just means that mums looking for products for their baby are looking for the same type of quality, the same type of ingredients. Five years ago, some markets were not ready and now they are,” Bosevski said.

After 27 years in the market, organic baby care brand Aromababy is also seeing the market opening up to baby care products. Where it used to be primarily an export brand, it is now finding its feet domestically with homegrown retailers such as Myers.

“The natural organic category in general is growing so you're seeing more availability and more acceptance in the wider market. The organic segment is so much more established, so it is now opening up in grocery and mass market stores, there's more opportunity and wider availability of our kind of product which is very premium,” said founder and CEO Catherine Cervasio.

From routines to rituals: Building bonds with baby

It cannot be overstated how deeply the COVID-19 pandemic altered the way we work and live. The course of COVID-19 left a mark on the family unit. It disrupted routines, altered familial roles, and changed family experiences in positive and negative ways.

These changes had a considerable impact on the baby care market. Essery told us that all the major trends that have accelerated during the pandemic, such as wellness and self-care have trickled down into baby care.

“It has absolutely changed 1000%. Just think to before, when we drop our kids off at childcare then rush to be at work at 9 o’clock. Now, people are more open, and we are encouraging parents to spend more time with their children, even if it’s just picking them up to see the smile on their faces,” said Essery.

“Going back to when we first started Lovekins, baby care was very routine based. But now, we’ve become more vulnerable as humans. We realised that life is quite precious, and this time spent on our family is precious. The bonding process starts from babyhood, through baby massage for example. That bonding is not just wellness and self-care it actually helps promote confidence and openness between parent and child.”

While in the past parents may seek out baby care products to solve skin irritation – a very common problem among babies – Essery said parents are turning to personal care products to deal with more than just cosmetic issues.

“Baby care is not something that is dictated by trends, but in saying that, we do see baby care evolving over time. Baby rituals are not going away so we are seeing products like sleep sprays or chest rubs for sick babies. Irritation of skin is not the only problem parents have, but also sleep patterns. We hope to alleviate some of these problems for parents with our product development.”

The company is also seeing room to grow its product range beyond traditional baby care.

Recently, Lovekins developed a line in collaboration with the brand’s in-house midwife, Aliza Carr. This professional series, which is endorsed by the Australian College of Midwives, helps support mothers on their antenatal and postpartum journey.

Currently, there are two products: a Perineum Massage Oil and After Birth Spray. The former is used for massaging the perineum before the baby is born to help improve skin elasticity which can reduce tearing during birth.

The After Birth Spray is used on the perineum after birth. It has anti-inflammatory properties to reduce swelling and pain associated with birth and to assist recovery and healing.

Both were developed from Carr’s experiences working with women who have undergone traumatic birth experiences.

Essery told us that it is keen to expand this line and find more ways it can help mothers and babies.

“There's always room to talk about the postpartum period. It's a short period of time but it's also a very crucial time for recovery. It’s becoming more popular to talk about now that over the last two years, we've seen families taking more of a priority.”

Baby vs adult skin: Formulation differences

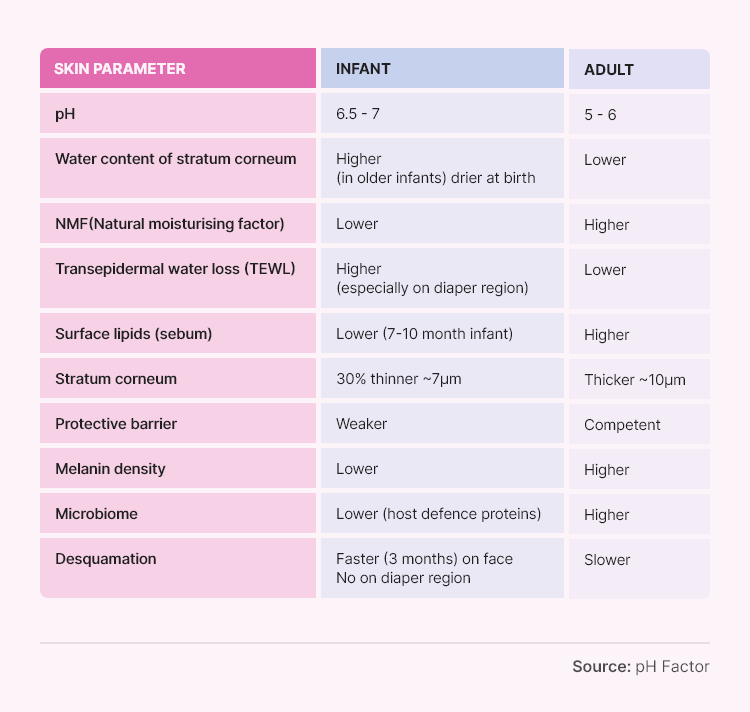

When it comes to developing products for baby’s, it is key to understand that their skin differs drastically from adults.

“When you look at the physiology of a baby's skin in general, we look at things like pH and thickness of skin – all those things come into play, so we have to choose the right ingredients. We wouldn't use highly acidic ingredients. We need to make sure we choose neutral ingredients, things that have a stronger lipid profile,” explained Rita Sellars, director and chief chemist of pH Factor, a cosmetic laboratory based in Australia.

One of the vital differences is the pH level of baby’s skin.

“When a baby is born up till about a year to a year and a half, it’s skin pH is really alkaline. It sits around 6.5 to 7, whereas adult skin sits, as we know, at pH 5.5. That’s a real crucial difference. So, we really have to understand that when we're formulating for baby care, we really need to make sure that we formulate, around pH 6.5 to seven and it can't sit lower than that,” said Sellars.

Another thing we have to consider is that the transepidermal water loss (TEWL) in adult skin is a lot higher than baby’s skin.

Differences between baby and adult skin

“When we look at the structure of the skin, it's not formed like adults. When you think about the epidermis, dermis, and hypodermis, they are so thin compared to what we have. So TEWL is very low, whereas in mature skin it's a lot higher. So as the as the child gets older, so around two to three years of age, that's when their skin starts to develop a little bit better.”

Sellars emphasised that disregarding the differences with baby’s skin could cause the products to disrupt the all-important skin barrier. “If we disrupt the baby's skin barrier, it's going to cause a lot of issues down the track.”

Sellars credits multinational Johnson & Johnson for pioneering what we know about baby’s skin today but notes that we still do not know enough about it.

“J&J were really the pioneers of baby care. They created the baby oil back in the 1930s because they understood that oil was really important for baby’s skin. I find that the start of life and the end of life are two areas that we just don't seem to concentrate on – and they are so important.”

One of the reasons why we do not know enough is the limitations when it comes to research.

“We don't have that luxury of testing ingredients and whether they're okay to use on animals, and we really can't test ingredients on babies. We send products out to test, we even do skin irritancy tests, but you can’t for baby care because you can’t test it on babies,” said Sellars.

Brands like Lovekins are keen to find out more about baby’s skin in order to develop products that can truly meet their needs. Essery told us that the company is currently learning more about baby’s skin, such as the vernix, a protective coating that forms on baby's skin in utero.

“When babies are just born, after they’ve been cocooning in the mother’s womb for nine months, they have this vernix – which is like a cheesy wax on their skin. It actually lasts for a week or two, even three weeks. That protective layer actually helps the moisturisation, so they don't lose hydration,” explained Essery.

“We have to continually promote the development of the skin as they get older, but not by taking away what nature intended.”

Seal of approval: Regulation and certifications

Cervasio noted that the baby care market is unique in that it does not rely on trends or the constant launching of new products. She added that the company’s philosophy is that baby skin should not be overloaded with product – something Sellars also advocates.

When it comes to growth, Aromababy is relying on opportunities to expand into new markets.

“You’ve got the established markets like Hong Kong and Singapore with growing appetite for natural, organic and high-quality baby products. But I see markets opening up like Malaysia and Vietnam. Vietnam especially is a growing market and quite interesting there,” said Cervasio.

“I think more countries are embracing high-quality natural and organic products so there's going to be a growing market there for them in countries from Singapore to Vietnam.”

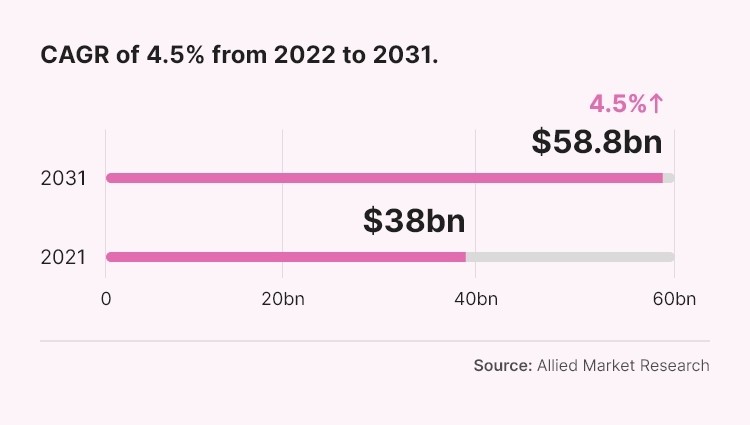

G&M Cosmetics has also been very aggressive with expansion as it is excited for the future of baby care in APAC especially.

“I think the future for the baby industry is healthy and growing. As the consumer reads and research, it's positive news for brands like us and anyone else entering the market because the opportunity is there, the gaps are there. The future is bright and we’re so excited to be doing business in APAC. There's lots of opportunities and we’ve got some more products that we are releasing in 2023,” Bosevski said.

While all three brands see huge opportunities in APAC, they all remarked that more stringent regulations would strengthen the market. Not only would it weed out brands that do not do their due diligence, but also give mums and dads confidence to try new products for their little ones.

“That's very important because it raises the bar for brands because we’re dealing with baby’s skin! That’s the most vulnerable skin we’re dealing with. I really welcome any changes because it puts us in the spotlight to make sure we are doing the right thing,” said Essery.

Bosevski added: “Be it baby or adult products, the industry is not heavily regulated, unfortunately. Many brands are just saying words. I think these groups and organisations like ASEAN should move forward and unifying the regulations.”

In 2021 China’s food and drug regulator drew up a new regulatory framework for cosmetics products targeted at children which came into force this year.

The National Medical Products Administration (NMPA) now requires all cosmetic products meant for children aged 12 to follow its guidelines.

For instance, it calls on manufacturers to focus on safety, efficacy and minimalist formulations when developing children’s cosmetics. It also requires products to be labelled with a designated logo, dubbed the ‘Little Golden Shield’.

Cervasio said she hoped to see something similar roll out in the wider APAC region, noting that she has had several discussions with certain organisations to come up with a benchmark.

“There's no one really that's been in the industry for as long as us, so if we can lead the charge and push for some criteria against greenwashing or misleading parents thinking something is safe and giving them false confidence. It’s important to tighten regulation around baby care.”

It is clear we still have a lot to learn about the skin needs of babies and children, and new learnings will only fuel the growth of the category. Regardless, brands that wish to succeed must place safety above all else to earn the role of a trustworthy partner to growing families.

![The rising demand for kid-friendly makeup is fuelled by the innate need for self-expression among Gen Alpha children and their millennial parents. [Evereden]](/var/wrbm_gb_food_pharma/storage/images/_aliases/wrbm_medium/publications/cosmetics/cosmeticsdesign-asia.com/article/2023/10/18/makeup-for-kids-need-for-self-expression-boosting-interest-in-kid-friendly-makeup/16823547-1-eng-GB/Makeup-for-kids-Need-for-self-expression-boosting-interest-in-kid-friendly-makeup.jpg)

![[Pundi Produce]](/var/wrbm_gb_food_pharma/storage/images/_aliases/wrbm_medium/publications/cosmetics/cosmeticsdesign-asia.com/headlines/market-trends/indigenous-interest-first-nations-farmers-of-australia-turn-to-cosmetics-for-commercialisation-opportunities/15956903-1-eng-GB/Indigenous-interest-First-Nations-farmers-of-Australia-turn-to-cosmetics-for-commercialisation-opportunities.jpg)

![A round-up of the top five stories trending online. [Getty Images]](/var/wrbm_gb_food_pharma/storage/images/_aliases/wrbm_medium/publications/cosmetics/cosmeticsdesign-asia.com/headlines/market-trends/top-5-beauty-and-cosmetics-stories-trending-on-cosmeticsdesign-asia-socials-right-now/15891626-1-eng-GB/Top-5-beauty-and-cosmetics-stories-trending-on-CosmeticsDesign-Asia-socials-right-now.jpg)

![Indus Valley is working to corner 30% of India's online premium boxed hair colour market. [Indus Valley]](/var/wrbm_gb_food_pharma/storage/images/_aliases/wrbm_tiny/publications/cosmetics/cosmeticsdesign-asia.com/article/2024/07/26/indus-valley-aims-to-secure-30-of-india-s-online-premium-hair-colour-market-with-organic-offerings/17594932-5-eng-GB/Indus-Valley-aims-to-secure-30-of-India-s-online-premium-hair-colour-market-with-organic-offerings.jpg)

![[Getty Images]](/var/wrbm_gb_food_pharma/storage/images/_aliases/wrbm_tiny/publications/cosmetics/cosmeticsdesign-asia.com/china/china-focus-latest-developments-in-china-s-booming-beauty-market25/17606695-1-eng-GB/China-focus-Latest-developments-in-China-s-booming-beauty-market.jpg)

![Kosé has launched makeup brand Visée in Singapore as part of plans to reinforce its position in SEA. [Visée]](/var/wrbm_gb_food_pharma/storage/images/_aliases/wrbm_tiny/publications/cosmetics/cosmeticsdesign-asia.com/headlines/business-financial/visee-singapore-kose-aims-to-enhance-brand-visibility-in-sea-with-new-launch/17587264-1-eng-GB/Visee-Singapore-Kose-aims-to-enhance-brand-visibility-in-SEA-with-new-launch.jpg)

![ble C&C is set on reinforcing its competitiveness in China’s beauty market. [Missha]](/var/wrbm_gb_food_pharma/storage/images/_aliases/wrbm_tiny/publications/cosmetics/cosmeticsdesign-asia.com/headlines/business-financial/able-c-c-aims-to-strengthen-competitiveness-in-china-through-online-expansion-kol-collabs/17591626-1-eng-GB/Able-C-C-aims-to-strengthen-competitiveness-in-China-through-online-expansion-KOL-collabs.jpg)

![LG H&H genetic study says 23 genetic regions affect natural skin tone. [Getty Images]](/var/wrbm_gb_food_pharma/storage/images/_aliases/wrbm_tiny/publications/cosmetics/cosmeticsdesign-asia.com/article/2024/07/23/lg-h-h-discovery-of-genetic-skin-tone-factors-in-east-asians-potentially-key-to-skin-radiance-developments/17587210-1-eng-GB/LG-H-H-discovery-of-genetic-skin-tone-factors-in-East-Asians-potentially-key-to-skin-radiance-developments.jpg)

![DR.CI:LABO expects brand-supplier partnerships gain more public prominence as consumers interest in skin care grows online. [Dr.Ci:Labo]](/var/wrbm_gb_food_pharma/storage/images/_aliases/wrbm_tiny/publications/cosmetics/cosmeticsdesign-asia.com/article/2024/07/22/brand-supplier-partnerships-will-come-to-the-fore-amid-the-online-skin-care-landscape-dr.ci-labo/17576755-1-eng-GB/Brand-supplier-partnerships-will-come-to-the-fore-amid-the-online-skin-care-landscape-DR.CI-LABO.png)