Hair has long been considered more than a defining feature of beauty. People have always attached significance to its quality and texture, believing it reflects our overall physical health.

In some cultures, hair is seen as a symbol of power, strength, and even dignity. In Hayao Miyazaki’s 1997 film, Princess Mononoke, our hero Ashitaka’s solemn quest begins when he cuts off his topknot, signifying the renunciation of his princely status and heritage.

Across Asia, we are familiar with such acts and their connotation being the loss of identity and castration. When the Manchurians conquered China, male subjects were forced to shave half their heads and wear the rest in a braided queue, which itself became an emblem of subjugation and oppression.

Today, our hair is equally significant, albeit in a less severe way. Since the 1920s, when women shorn off their locks in an act of liberation and rebellion, hair as medium of self-expression has not changed. We still spend hours and dollars styling, teasing, and colouring our tresses, shaping them to convey who we are to society.

Given how important it is to us, we consider caring for our hair as a form of pampering. It is possible many of us thought little of this indulgence until COVID-19 struck and forced the closure of hair salons.

Against this backdrop, people had to take matters into their own hands. They attempted to cut their own hair and experimented with DIY hair care. The renewed interest in hair care coincided with consumers’ focus on health, well-being, and sustainability.

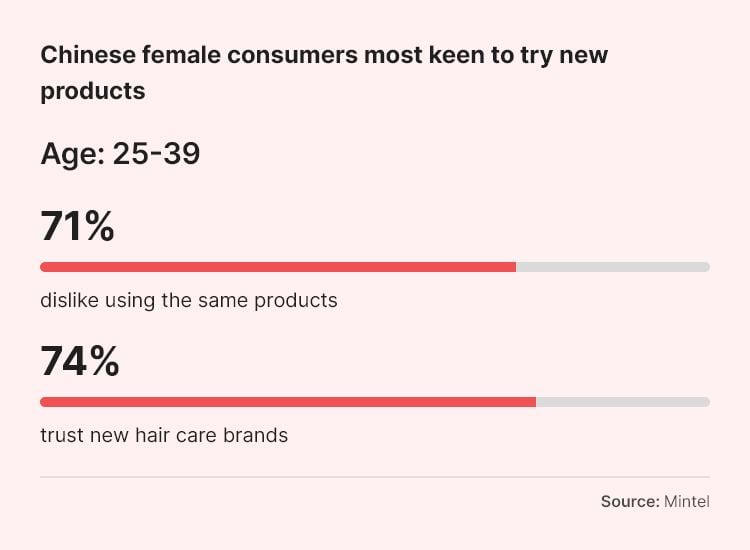

This indicates new opportunities for companies to innovate and meet the growing diversity of hair needs and concerns of consumers.

Beauty’s new growth driver

It is no wonder that hair care is one of the new growth engines for beauty companies like Estée Lauder, which launched hair care brand Aveda in China in 2022.

“We have launched Aveda in China for a reason. We have seen clear signs of the development of luxury haircare. Obviously, hair care is a category super well-developed among the Chinese consumers, but it’s mainly developed in mass. It’s the beginning of the journey of the development of luxury hair care, sustainable hair care,” said CEO Fabrizio Freda.

Kosé Corporation is known best for its skin care brands such as Decorté and Sekkisei. However, the company is eyeing opportunities in the hair care market.

After launching Stephen Knoll New York in Singapore mid-2022, Kosé is working to expand the brand’s footprint in the market, believing can fill an important gap between mass market and professional brands.

“Our positioning is a bit different from the typical cute and colourful Japanese hair care products. It’s modern, chic, and sophisticated, yet its affordable. And still it’s got that edge because it’s got Japanese technology behind it,” said Lim Yifang, brand manager, Kosé Singapore.

Nuggela & Sulé is one of the leading hair care brands in its home market and is the top-ranking shampoo on Amazon. It is available in pharmacies and department stores with more than 5,000 touchpoints.

The eight-year-old brand has made headway in two Asian markets, China and Singapore, and is now exploring opportunities in Indonesia, Vietnam and Taiwan.

“Yes, the European market is more developed than the Asian market in terms of the kind of brands and products available. But countries like Vietnam and Indonesia I think have huge potential to grow,” said Anabel Ruiz Cayuela, export manager of Spanish hair care brand Nuggela & Sulé.

“In general, the haircare market in Asia represents many untapped opportunities. Especially the emerging markets, they are welcoming to new brands, new products. I think that over the next years, you will see us growing in the region.”

In Asia, the brand has observed similar concerns such as hair loss and scalp irritation, as well as more unique ones.

“Asian consumers are having more problem with hair lacking volume. In many of the countries here, consumers face extremely humid conditions and that affects the appearance of hair as well. So that’s one concern from an aesthetic point of view,” said Cayuela.

‘Hair care is the new skin care’

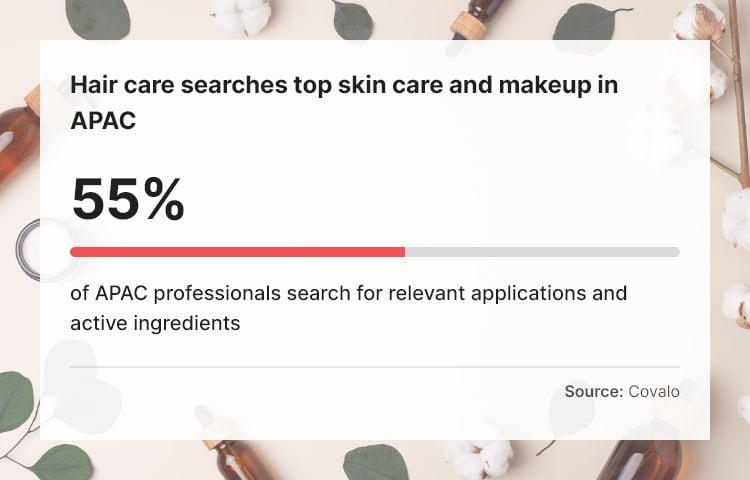

L’Oréal Group CEO Nicolas Hieronimus recently commented during the firm’s 2022 earnings call that hair care had become the new skin care.

“We see longer hair, more diverse types of hair. And great hair is increasingly a sign of health. People invest in it with a strong appetite for professional products and premium mass products,” he said.

Given what we understand about the ever-demanding Asian beauty consumer, we know they will expect their hair care products to contain the same level of innovation they are used to in skin care.

Skin care brands like The Ordinary, Dr Barbara Sturm, Drunk Elephant and Evenswiss, have capitalised on this by launching hair care products, which grew to be successful on the back of the brands’ prominence in skin care.

Unsurprisingly, there is a strong focus on ingredients, specifically, natural ingredients.

“What’s trending in hair care now is really potent ingredients that are formulated with plant-based or botanical ingredients that can give great effects,” said Dr Ananthi Krunanathi, senior manager of medical affairs, Herbal Pharm, a health foods and supplements company that recently developed its first hair care brand, Revivogen.

Karen Lam, director of Singapore-based hair care brand Verdure emphasised that the consumer demand for natural and organic ingredients stems from safety concerns.

“In general, hair care customers are looking for high-quality, effective products that are safe and gentle for their hair and skin. They may be concerned about the health and well-being of their hair and scalp and are looking for products that are free of harmful chemicals.”

In South Korea, emphasis on health has been influenced in part by the clean beauty movement, said Chon Sangchul, business manager of Seppic Korea.

This in turn is fuelling the demand for silicone-free hair care products. “The silicone-free hair care trend is one of the most important trends in Korea because the big trend is clean beauty, which is about health, safety and considering the environment,” said Chon.

Safety in hair care is set to become an even greater talking point, as cult-favourite hair care brand Olaplex has recently come under fire for allegedly causing a host of issues, including hair loss.

In February 2023, nearly 30 consumers filed a lawsuit against the brand, causing a wave of alarm among consumers. Olaplex's CEO JuE Wong has hit back at the “baseless accusations”, asserting that none of Olaplex’s products cause hair loss or breakage in a LinkedIn post.

“Olaplex products are safe and effective, as millions of our customers can happily attest. To demonstrate this, we have publicly released test results from independent third-party laboratories, going above and beyond industry standards. We have full confidence and believe in the safety and efficacy of our products.”

Wong highlighted the opinions of several experts, which agreed that it was unlikely that Olaplex would cause hair loss. She concluded that firm would “vigorously defend” the company and its products.

However, regardless of the outcome, we can be sure that this high-profile lawsuit will fuel the consumers’ quest for safe ingredients.

Scalp care: An extension of skin care

At the heart of the skinification movement is scalp care, which consumers are growing to accept as an extension of their skin.

“Scalp health is becoming an increasingly important concern for many consumers, and companies are focusing on developing products that address specific scalp concerns such as dryness, dandruff, and itching,” said Lam.

Consumers were willing to invest more in hair care, especially for scalp care products, said Lim, who noted that many of Stephen Knoll New York bestsellers were scalp care products. “We realised that whatever scalp product we push out ends up doing really well.”

As scalp care is a relatively new space within the hair care category, education will continue to be vital.

Lim observed that not many consumers in Singapore understand the importance of a clean scalp and its implications on the overall health of hair.

Lam added that it was continued education in scalp health was crucial. “Addressing the scalp as an integral part of your skin and requiring the same level of complex care as different skin types and concerns is something we need to educate customers on.”

In addition to education, more research needs to be conducted on the scalp, said Cayuela. She noted that one of the areas Nuggela & Sulé was focusing its research on was the scalp microbiome, which is set to become an important talking point.

“We are developing products that focus on microbiota. What we are investigating more in-depth is working with new ingredients and formulas that can help. For example, how can we proliferate the beneficial organisms and prevent the appearance of bad ones? And how is that going to affect our scalp and hair in the long-term? That’s what we are studying now in more detail to develop products that help the microbiota.”

In addition to that, the company is also studying the differences between Caucasian and Asian hair and scalp.

“[Research on Asian hair] is very important in order to adapt the products to this region. As long as we keep growing in the region, our efficacy tests also have to include the Asian type of hair because it's different.”

More innovation wanted!

It is astonishing that we are only beginning to view scalp care as part of our skin care regime. Compared to the other beauty categories, like skin care and makeup, innovation in hair care has been relatively stagnant.

CosmeticsDesign-Asia reported last year that K-beauty majors Amorepacific and LG Household & Healthcare (LG H&H) have both launched shampoos that can conceal grey hairs to great success, signalling a huge demand for anti-ageing hair care products.

Marianne Peltier, managing director, cosmetics Asia, Sensient, told us she was confident this trend will find its way into the wider Asian region, especially as greying hair is a concern among men and women across markets.

“Clearly Asia follows Korean trends, now that we have two big Korean brands following this, we will soon see more following.”

She added that this would pave the way for manufacturers to develop semi-permanent hair dye shampoos in more colours. There are already such products available in Japan’s professional market, with players like well-known salon brand Milbon coming up with a rainbow of colours.

Such products could be used to maintain professional permanent hair dyes, or simply to experiment with new colours. “We’re seeing this especially among the Gen Z, they like intense colours, they like to change and experiment and express themselves,” said Peltier.

Additionally, shifting beauty standards in Asia are fuelling more innovation. In the past, straight and silky hair was considered the ideal. However, there is a growing appreciation for diverse hair textures and styles.

This has led to an increased demand for products that can help people achieve a wider range of hair styles, from loose waves to tight curls.

This mirrors trends in North America and Europe which have seen more acceptance for natural hair as more people have started to embrace diversity in recent years.

Last year, India-based Arata launched a line of hair care products for curly hair. The founders decided to develop the eight-piece range to counter the long-held beauty standard of sleek and straight hair in many societies in the Asia region.

“The core philosophy behind our curl range development was to reinforce that the definition of beautiful isn’t confined to straight hair and to make the curly haired community feel empowered, heard, and understood,” said co-founder Dhruv Bhasin.

Fellow co-founder Dhruv Madhok added: “We set out to showcase what curly hair was capable of morphing into when given the chance, instead of dooming them to the flat-iron fate.”

The inclusive beauty movement is also driving Verdure to explore how it can develop products for the men’s hair care market.

“While there has been a lot of focus on women's hair care in recent years, the men's hair care market is by comparison, relatively untapped and offers significant growth potential and innovation,” said Lam.

Lam also believes the hair care market is due for a tech upgrade. The company has developed two devices, one based on LED light therapy and ionic vibration technologies, which it believes is key to hair and scalp health.

“I think the hair care industry has been grossly neglected and under-served in terms of innovation, particularly with devices. Much of that owes to the fact that research into the science of hair loss, and consequently, hair growth is still very limited,” said Lam.

The company hopes to marry technology with the ever-increasing demand for personalisation.

“The trend towards personalised hair care solutions is on the rise, and with the rise of AI technology, tailored and customised hair care regimens to meet the specific needs of individual customers will be something we hope to achieve in the near future,” said Lam.

She added that the hair care makers should also push sustainable innovation.

“As consumers become more environmentally conscious, there is a growing demand for sustainable and eco-friendly packaging options in hair care. Brands that can offer innovative, environmentally friendly packaging solutions may have an advantage in the market.”

The consumer interest in self-care looks set to continue and their approach to hair care will shift accordingly. Hair care is still in the early stages of its innovation journey, but brands can look to other categories like skin care for inspiration in terms of ingredients, trends, and rituals.